Understanding Roof Insurance Claims: A Comprehensive Guide

Outline:

– Overview and relevance: how claims, coverage, and roofing intersect

– The claims process step-by-step, from emergency measures to final payment

– Coverage essentials: policy forms, ACV vs. RCV, deductibles, exclusions, and code upgrades

– Roofing materials and risk: how construction choices influence claims and costs

– Prevention, documentation, and working with professionals to protect value

Introduction: Why Roof Insurance Claims Matter

Roofs are the quiet guardians of a home, working in the background while storms, sun, and temperature swings try to pry them open. When something fails, it rarely happens in a neat, single moment; moisture creeps along flashing, wind lifts a few tabs, or a branch scuffs a membrane that later becomes a leak. For homeowners and property managers, roof issues are among the most consequential maintenance events because they involve both structural protection and interior preservation. Claims, coverage, and the roofing system itself are a three-legged stool: remove or misunderstand one, and the other two wobble.

In many regions, wind and hail claims rank among the most frequently reported home insurance losses, reflecting how weather patterns, roof age, and material choices combine to drive risk. Even small openings—like a nail pop or a compromised ridge vent—can allow water intrusion that damages insulation, drywall, and flooring. The financial range is broad: minor repairs may be a few hundred dollars, while full replacements can reach a five-figure expense depending on size, pitch, materials, and local labor rates. Navigating whether damage is sudden and accidental (typically insurable) or due to wear and tear (generally excluded) can be the difference between a covered event and an out‑of‑pocket repair.

Understanding how a claim is documented, how coverage applies, and how roofing materials perform allows you to make decisions quickly and confidently. That knowledge streamlines conversations with adjusters, clarifies contractor bids, and helps you weigh repair versus replacement. Consider this guide your field map. It blends practical steps, real‑world examples, and clear comparisons so that when the first drip appears—or the forecast turns ominous—you can protect your investment without panic.

The Claims Process: From First Drip to Final Payment

The claims journey begins with safety and mitigation. If water is entering the structure, place buckets, cover valuables, and use plastic sheeting or tarps to prevent further damage. Insurers typically expect “reasonable steps” to limit loss, and documenting those actions shows diligence. Next, capture evidence before anything moves: wide shots of the roof, close‑ups of damaged shingles or seams, interior ceiling stains, and any debris that may indicate the cause.

Time matters. Policies often include prompt notice requirements, and waiting weeks can complicate cause and scope. When you file, provide a clear timeline: date of storm or discovery, immediate steps taken, and any emergency repair invoices. Be precise but concise; clarity helps your file move faster. The adjuster’s inspection is usually the pivot point. Expect them to evaluate slope, materials, hail or wind signatures, soft metal marks, compromised seal strips, flashing, and underlayment exposure. If safe access is impossible, drone or pole photography can supplement.

Organize evidence so it tells one story. Helpful items include:

– Date‑stamped photos from multiple angles

– Roofer notes describing slopes, squares, and specific damage

– Copies of prior roof work invoices and any warranties

– A simple diagram labeling slopes, penetrations, and valleys

– Weather logs or local reports tied to the claimed date

Estimates should be detailed, not vague. Look for line items per slope and per component—shingles or membrane squares, starter, ridge, underlayment, ice and water shield, flashing, vents, and disposal. Clear scope facilitates apples‑to‑apples comparisons and helps adjusters validate pricing. Many claims pay in two parts under replacement cost policies: an initial actual cash value (ACV) payment that reflects depreciation, followed by recoverable depreciation after approved work is completed. Keep invoices and completion photos ready; missing documentation delays the second payment. Throughout, meet deadlines, ask for communications in writing, and keep a claim diary. The process rewards organization and transparency.

Coverage Essentials: Policy Forms, Deductibles, and the Fine Print

Coverage for roof damage typically lives under the dwelling portion of a homeowner policy. Understanding how your policy is written—and how it values your roof—shapes outcomes. A key distinction is ACV versus RCV. ACV pays the depreciated value of the roof at the time of loss, while RCV aims to pay the cost to replace with like kind and quality, subject to your deductible and policy limits. Depreciation often tracks age, condition, and expected lifespan; a 15‑year‑old shingle roof may see more depreciation than a 5‑year‑old metal panel roof.

Deductibles set your out‑of‑pocket floor. Some policies use a flat deductible, while wind or hail can carry a separate percentage deductible tied to the dwelling limit. For example, with a $300,000 dwelling limit and a 2% wind/hail deductible, your share would be $6,000 for that peril. That math influences whether it makes sense to file for minor repairs. Coverage forms matter too. “Open perils” on the dwelling typically cover all risks unless excluded, whereas “named perils” only cover listed causes. Common exclusions include wear and tear, deterioration, mechanical breakdown, and faulty workmanship. Policy endorsements can fill gaps: code upgrade (often called ordinance or law), matching of undamaged materials, and extended replacement cost can add meaningful protection.

Key items to review and discuss with your agent or broker:

– Roof settlement terms: ACV only, RCV with conditions, or age‑based schedules

– Separate wind/hail deductibles and any territory‑specific changes

– Cosmetic damage limitations for metal roofs

– Coverage for solar attachments, skylights, and satellite penetrations

– Debris removal sublimits and additional living expense if the home is uninhabitable

Finally, local code compliance matters. If your jurisdiction now requires ice and water protection along eaves or specific nailing patterns, a code upgrade endorsement can help pay the difference between old and new standards after a covered loss. Without it, you may shoulder that delta. In short, coverage is a contract: read it, annotate it, and keep a copy with your home records so the fine print never surprises you on a windy night.

Roofing Materials and Risk: How Construction Choices Affect Claims

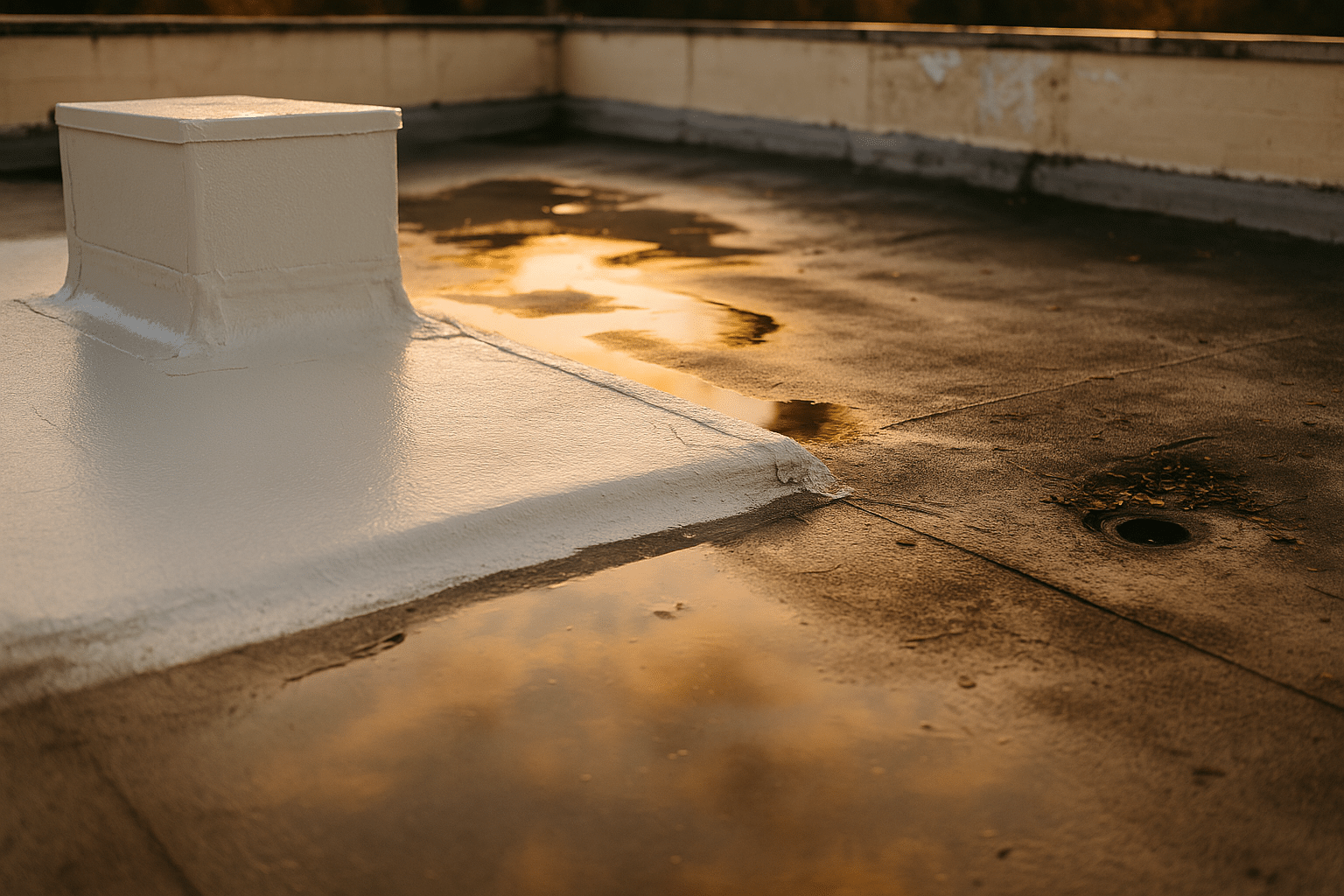

Not all roofs face storms equally. Material, installation quality, roof geometry, and ventilation shape both durability and claims outcomes. Asphalt shingles remain widely used because they balance cost, weight, and ease of repair. They come in various profiles and ratings, including products designed to resist impacts. Metal panels offer notable wind resistance and shed snow efficiently, though panels can show cosmetic dents from hail that may or may not be covered depending on policy language. Tile and slate deliver longevity and fire resistance but are heavier and more brittle under impact, with higher repair costs and specialized labor. Low‑slope systems—such as modified bitumen, built‑up assemblies, and single‑ply membranes—have different vulnerabilities, like seam failure, ponding water, or punctures from debris.

Key comparisons to consider:

– Lifespan expectations vary widely: some shingles may be rated around two to three decades, many metal and tile systems can exceed that when maintained.

– Wind ratings and fastening methods influence performance on ridges and edges where uplift forces are highest.

– Impact ratings can mitigate hail damage, though “impact‑resistant” often reduces, not eliminates, the chance of functional impairment.

– Underlayment choices—synthetic sheets, ice and water barriers, or self‑adhered membranes—affect moisture protection if outer layers are compromised.

Installation quality is the multiplier. Proper flashing around chimneys and walls, clean valleys, adequate intake and exhaust ventilation, and consistent fastener placement can mean the difference between a storm that passes and a claim that lingers. From a claims perspective, detailed documentation of what was installed helps enormously later. Keep the contract scope, product data sheets, permits, and inspection sign‑offs. If a future claim arises, these records help differentiate sudden damage from pre‑existing conditions.

Cost dynamics are also material‑driven. An asphalt replacement on a typical home might fall in the lower five figures depending on region and complexity, while tile, metal, or slate can run higher due to materials and skilled labor. Low‑slope systems vary based on layers, insulation, and access. Before storms ever arrive, selecting materials that align with local weather, building codes, and your tolerance for maintenance is both a construction decision and a risk‑management choice.

Strengthening Your Claim and Preventing Future Damage

The strongest claims begin before the first cloud gathers. A tidy roof record—photos from installation, annual inspection notes, and receipts—creates a baseline that proves condition over time. Schedule a roof check at least once a year and after major storms. Small fixes today, like resealing flashing or resetting a lifted shingle, prevent complex interior damage tomorrow. Prevention blends housekeeping, smart upgrades, and a measured response when weather strikes.

A practical maintenance rhythm:

– Clear gutters and downspouts each season to prevent water backing under edges

– Trim branches that can scuff, puncture, or drop limbs

– Inspect penetrations (vents, skylights, satellite bases) for cracked seals

– Look for shingle granules accumulating in gutters, a sign of aging

– Check attic ventilation and look for daylight at roof joints

When storms pass, walk the property before walking the roof. Photograph displaced granules on walkways, dents in soft metals, and shingle tabs lifted along ridges. If you hire a roofer to inspect, ask for a short written memo with labeled photos and a measurement of affected squares. For the claim file, create a simple chronology: the event date, steps to mitigate, who inspected, and what was found. Keep conversations with the insurer in writing when possible. If the initial estimate misses components—like starter course, drip edge, or ice barrier—politely request a supplement with a line‑by‑line rationale.

Choosing contractors requires care. Seek licensed and insured professionals, confirm local permits, and request an itemized scope that lists materials, underlayments, flashing details, and ventilation plans. Avoid high‑pressure tactics and read authorizations thoroughly, especially any language assigning benefits or directing insurance rights. Payment schedules should align with milestones—deposit, material delivery, and completion—rather than large upfront sums. Consider mitigation upgrades where feasible: impact‑rated shingles, enhanced nailing patterns, sealed roof deck layers in high‑wind areas, and improved attic ventilation. While no measure can eliminate risk, thoughtful prevention lowers the odds of loss, supports fair claim outcomes, and protects the structure you live in every day.