Understanding Roof Insurance Claims: A Comprehensive Guide

Roof damage is one of the most common reasons homeowners interact with their insurance, yet it remains one of the most confusing. Policies use specialized terms, roofing systems age differently, and local codes can shift the rules midstream. The stakes are high: a well-handled claim can restore a home’s resilience, while a misstep may lead to denials, delays, or future leaks. This guide connects the dots between coverage, claims, and roofing so you can make decisions with confidence.

Outline:

– Coverage fundamentals that shape outcomes

– Step-by-step claims process and timeline

– Roofing materials, lifespans, and risk factors

– Inspections, documentation, and dispute pathways

– Prevention, budgeting, and an action-oriented conclusion

Decoding Coverage for Roofs: What’s In, What’s Out, and Why It Matters

Insurance coverage for roofs is a balance of what’s protected, what’s excluded, and how payments are calculated. Most homeowners policies fall into two broad models: named-peril (covering listed risks like wind, hail, and fire) and open-peril (covering everything except exclusions). For roof claims, the headline questions involve whether a sudden event caused the damage, how old the roof is, and whether the policy pays actual cash value (ACV) or replacement cost value (RCV). ACV subtracts depreciation for age and condition, while RCV aims to make you whole after the work is completed, often releasing recoverable depreciation when repairs are verified.

Age and maintenance loom large. Some policies include a roof-surface schedule that reduces payouts as the roof ages, especially for common materials like asphalt shingles. Cosmetic damage, particularly on metal roofs, may be excluded unless it affects function. Wear and tear, installation defects, neglect, and pre-existing issues are routinely excluded. Many policies require an opening in the roof for interior water damage to be covered; wind-driven rain without exterior damage can be denied. Endorsements can change the picture: ordinance or law coverage helps with costs to upgrade to current codes; matching coverage can address visible mismatches; and endorsements for wind or hail may add a percentage deductible.

Consider a practical scenario. A 12-year-old asphalt shingle roof is struck by hail. If the policy includes RCV with recoverable depreciation, the initial payment may reflect ACV (for example, estimate minus deductible minus depreciation). After the roof is replaced and documents are submitted, the insurer releases the recoverable depreciation. If the roof has a separate 2% wind/hail deductible, that amount is calculated against the dwelling limit, not the repair bill. Key decisions before a storm even arrives include: – Choosing RCV vs ACV if available – Adding ordinance or law coverage for code-required upgrades – Understanding whether the policy limits cosmetic-only claims – Reviewing wind/hail deductibles and named-storm provisions

A few signals help you gauge coverage strength: – Clear definitions for cosmetic vs functional damage – Explicit treatment of matching on visible planes – Reasonable depreciation rules tied to material lifespans – Sufficient limits for code upgrades and flashing or decking replacements. The right combination won’t eliminate every gray area, but it narrows the gaps that most often cause frustration.

From First Notice to Final Payment: How Roof Claims Actually Work

When a storm hits, the claim clock starts with immediate mitigation. Prevent further damage by tarping or covering exposed areas and documenting the steps you took. Then file the first notice of loss (FNOL) with your insurer, providing the time and date of the event, a brief description, and whether you’ve taken emergency measures. Insurers often acknowledge claims within a few days and schedule an inspection. Timeframes vary by region, surge demand after major weather, and policy terms, but many homeowners see an initial inspection within one to two weeks during normal conditions.

Documentation shapes outcomes. Create a folder with photos, short video clips, and notes. Capture wide shots of each roof slope and close-ups of damage like missing tabs, bruised shingles, creased edges, displaced flashing, dented vents, and granule accumulation in gutters. Photograph collateral signs: hail splatter on downspouts, impacts on fences, damage to soft metals, and leaf litter patterns that suggest wind direction. Keep receipts for mitigation, temporary housing if needed, and any emergency repairs authorized by your insurer. Useful items to gather include: – Photos before mitigation and after – Roof age, material type, and any warranties – A simple diagram of slopes and penetrations – Permits or past invoices for repairs or replacements – Weather references (date, approximate time, and storm type)

The inspection and estimate follow. An adjuster or independent inspector assesses the roof, attic, and exterior. You may receive an estimate with line items for removal, underlayment, shingles or panels, flashing, vents, code upgrades (if applicable), and labor. ACV policies pay the depreciated amount upfront; RCV typically issues an initial ACV payment, then releases recoverable depreciation when work is complete. Supplements are common if hidden damage is discovered, such as brittle decking, additional layers of old shingles, or unforeseen flashing requirements. If your mortgage company is listed on the policy, checks may include the lender as a payee; plan time for endorsements.

Common milestones and timeframes include: – FNOL and claim number: within 24–72 hours – Initial inspection: often 3–14 days in non-surge conditions – Estimate and first payment: typically within a week of inspection approval – Repair scheduling: 1–6 weeks depending on contractor backlog – Completion and recoverable depreciation: 1–3 weeks after documentation – Dispute or reinspection: variable, often within 2–4 weeks. Clear communication, thorough documentation, and prompt responses keep the process moving toward a fair settlement.

Roofing Materials, Lifespans, and Risk: How Construction Drives Claim Outcomes

Every roof is a system, not just a visible surface. The underlayment, deck, flashings, vents, and fasteners interact with the weather, and insurers look at how the system performs under stress. Materials age at different rates and behave differently when struck by wind or hail. Asphalt shingles are common and comparatively affordable; they can show granule loss, bruising, and creased tabs after storms. Metal sheds water efficiently and resists fire, yet may show cosmetic dents that don’t impair function. Tile and slate offer long lifespans but are heavy, expensive to repair, and susceptible to cracking from impact. Low-slope systems use membranes that rely on seam integrity and drainage.

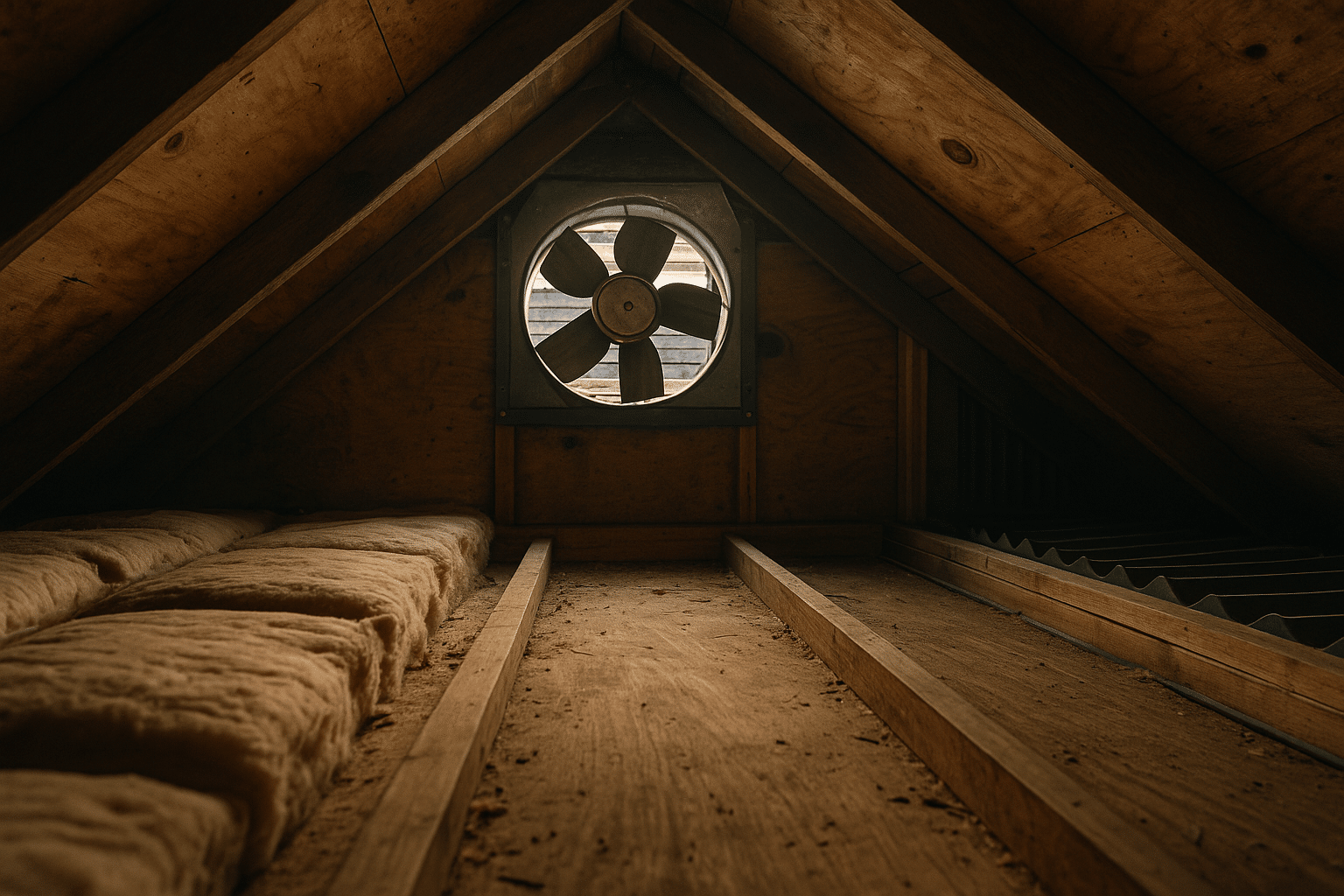

Typical lifespan ranges under normal conditions include: – Asphalt shingles: roughly 15–30 years depending on grade and climate – Metal panels: roughly 40–70 years with proper maintenance – Concrete or clay tile: often 50 years or more – Slate: 75–100 years with careful upkeep – Low-slope membranes (e.g., modified bitumen, TPO, EPDM): commonly 15–30 years. Ventilation and climate can nudge these ranges up or down; poor attic airflow accelerates shingle aging, and salt-laden or high-UV environments are harsher on finishes and sealants.

Construction details influence claims. Impact-rated products can reduce functional damage from hail; enhanced nailing patterns and proper starter strips improve wind resistance; ice and water barriers add resilience in valleys and eaves; and well-formed flashing at chimneys and sidewalls prevents chronic leaks. Insurers may distinguish between functional and cosmetic damage, especially on metal. If performance isn’t impaired—no punctures, coating failure leading to rust, or compromised seams—some policies won’t pay for surface-level dents. On shingle roofs, brittle-tab tests and uplift checks help determine repairability versus replacement.

Cost dynamics matter as well. Roof replacement costs commonly reflect labor, tear-off, disposal, underlayment upgrades, ventilation improvements, and accessories like drip edge or ridge ventilation. Code-driven changes can add meaningful expense, which is why ordinance or law coverage can be valuable. Regional risk affects pricing and deductibles; areas with frequent wind or hail may use percentage deductibles or sublimits for roof surfaces. Proactive choices—like correct ventilation, reliable flashing, and timely maintenance—reduce claim frequency and improve longevity, adding a layer of financial resilience beyond the policy itself.

Evidence, Inspections, and Disputes: Building a Claim File That Holds Up

A strong claim file shows what happened, when it happened, and how it affected the roof’s function. Begin with clear scene documentation right after the event. Note the date and approximate time, weather conditions, and any immediate impacts you observed. Photograph downed limbs, fresh dents in soft metals, missing shingles, and any interior staining that appeared after the storm. In the attic, look for daylight at nail holes, wet sheathing, and damp insulation. On the roof, a professional should differentiate between normal wear, thermal blisters, manufacturing anomalies, footfall damage, and storm-related impacts. This distinction is central to many approvals and denials.

When reviewing an estimate or scope, pay attention to details. Does the line item include removal and replacement for flashings at chimneys, step walls, and valleys? Is an ice and water barrier included where codes require it? Are ridge caps, starter courses, and hip-and-ridge components correctly specified? Does the deck require re-nailing after tear-off? If the roof has multiple facets, does the plan address transitions and penetrations (pipes, vents, skylights)? A few checkpoints to consider: – Are materials and quantities aligned with measurements? – Do unit prices reflect local market norms? – Are code-required items listed explicitly? – Is ventilation balanced between intake and exhaust?

Disagreements happen, and most policies include pathways to resolution. Start with a courteous request for reinspection, providing additional photos, contractor opinions, or code citations. If differences persist, the appraisal clause—when present—offers a structured process where each party selects an appraiser and an umpire resolves remaining differences. Mediation or arbitration may be options under state rules. Some policyholders consult licensed professionals to help document damage or navigate negotiations. Track deadlines: policies may require prompt notice, proof-of-loss submissions, and have time limits for suits or appraisals. Weather documentation, such as publicly available storm reports and radar summaries for the date of loss, can strengthen the timeline. Organized, factual evidence reduces friction and nudges the process toward a fair, timely outcome.

Conclusion and Action Plan: Maintenance, Budgeting, and Smarter Decisions

Insurance is a safety net, but maintenance is your everyday shield. A simple seasonal routine can shrink both damage risk and claim stress. In spring, check for lifted shingles, hail marks on soft metals, clogged gutters, and loose flashing. In summer, verify ventilation and look for heat stress or curling. In fall, clear debris before storms and confirm that sealants and fasteners are sound. In winter, watch for ice dams at eaves and valleys. Keep a log with dates, photos, and small fixes; this record helps show care and can bolster a claim if a storm arrives.

Budgeting supports smart choices. Set aside an annual amount for minor repairs and inspections—catching a flashing issue or small leak early can prevent sheathing damage and interior repairs. If you’re approaching the end of a roof’s typical lifespan, obtain a professional assessment and a few written estimates for replacement. Consider materials with stronger wind or impact performance where regional weather justifies it, and review your policy’s deductibles and endorsements to match those risks. An action-oriented checklist helps: – Schedule roof and attic checks twice a year – Photograph each slope and key penetrations – Clean gutters and downspouts after major storms – Save invoices and permits in a single folder – Review policy terms at renewal for roof-specific changes

Finally, be deliberate about when to file a claim. Small repairs that cost less than your deductible, or that pose limited risk of spreading damage, may be handled out of pocket. Large, sudden, and storm-linked losses are the reason coverage exists. Vet contractors carefully: confirm licensing where required, ensure written scopes and warranties, and avoid signing documents that assign all claim rights without clear limits. Communicate early with your insurer, respond promptly to requests, and keep your documentation tidy. With a resilient roof, a clear grasp of coverage, and a disciplined approach to claims, you can protect your home and your budget—rain or shine.